No Crypto Company Can Operate Without Complying With N.S.A – CHAPTER[1.12] |  |

- No Crypto Company Can Operate Without Complying With N.S.A – CHAPTER[1.12]

- Bitcoin, RFID, Blockchain and the Cashless Society Agenda – CHAPTER[1.11]

- Banks Don't Hate Bitcoin Because They Funded It – CHAPTER[1.10]

- Unveiling The Bitcoin Team Led By Nick Szabo – CHAPTER[1.9]

- Where Did ‘Nick Szabo’ Code Bitcoin Software? – CHAPTER[1.8]

- How Did We Hunt Down ‘Nick Szabo’ To Be ‘Nakamoto Satoshi’? – CHAPTER[1.7]

- Meet Nick Szabo: The Silent Genius Who Created Bitcoin – CHAPTER[1.6]

- Who Actually Created Bitcoin and Who Did not? – CHAPTER[1.5]

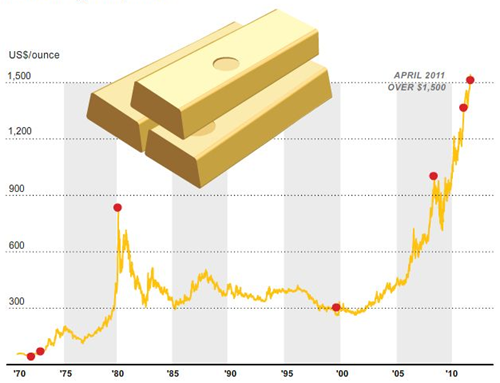

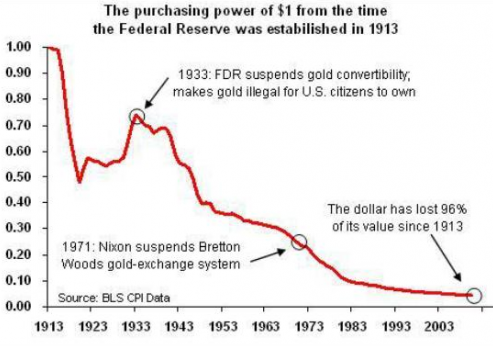

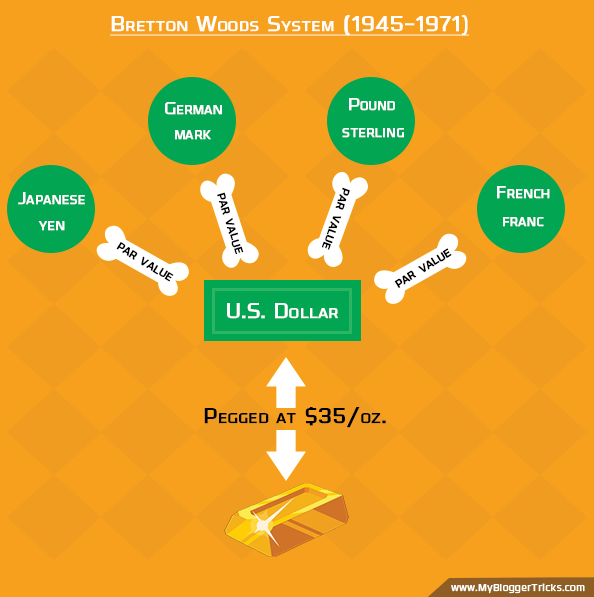

- Why Banking Elite Hates Gold Standard But Loves Fiat? – CHAPTER[1.3]

- Major Differences Between Gold Vs. Bitcoin Vs. Paper – CHAPTER[1.4]

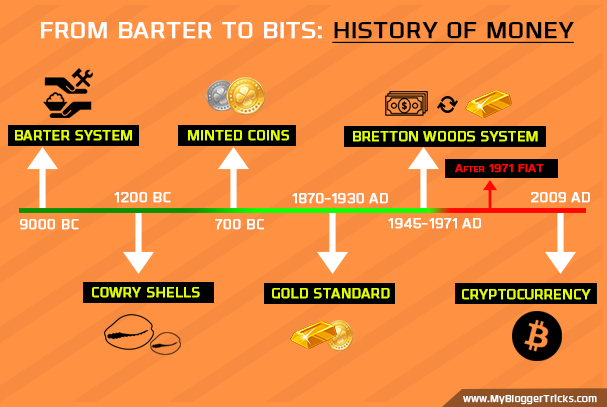

- From Barter To Bits – History Of Money – CHAPTER[1.2]

- It all Started With "Gold is Worthless!" – CHAPTER[1.1]

- Bitcoin Is The Second Greatest Scam In The History Of Mankind – CHAPTER[1]

| No Crypto Company Can Operate Without Complying With N.S.A – CHAPTER[1.12] Posted: 12 Jun 2018 09:26 AM PDT Without those leaked global surveillance disclosures of 2013 by a former CIA employee, N.S.A contractor and now a Russian resident, Edward Snowden, the world would have never known or believed, that the very corporate companies that they trust, are providing private information of its customers through back doors, willingly to CIA, FBI and N.S.A. Most importantly bitcoin community would have simply ignored what I had shared so far and what I am about to reveal in this chapter. Who would have known that the email we send via Gmail or Yahoo or Hotmail are being read in real time through electronic eavesdropping by a NSA employee. Who would have imagined that the video or audio calls we make on Skype, Facebook or Apple Facetime are being watched by a CIA spy, sitting in Washington D.C. N.S.A exists even before the birth of internet, the first home PC or the first operating system(OS). For the past 65 years since its birth in 1952, N.S.A has been waging a war against encryption protection of everyday Internet communications. N.S.A.'s success lies in weakening encryption standards either by:

With an annual budget of over $11 billion, N.S.A has deployed its own custom-built, superfast computers to break widely used Internet encryption technologies that the normal world considers unbreakable or impossible to decrypt. N.S.A's code-breaking capabilities are the best in the world and unbeatable in terms of advanced technology. A short trailer was seen when NSA's Eternalblue exploit was used in WannaCry Ransomware attack, that infected 300,000 computers, across 150 countries within a span of just 4 days! WannaCry was a perfect "Bitcoin Publicity Stunt" by N.S.A to bring mainstream media attention to Bitcoin with no fingerprints attached. . Bitcoin became an internationally discussed topic since then. After WannaCry Ransomware attack(May 2017), Bitcoin price increased by 931% within 7 months! Contrary to its 8 years of almost no exceptional price movement. More details (images, graphs and facts and figures) on how NSA was involved in WannaCry Ransomware attack, has been discussed comprehensively in Chapter#2. Stay tuned because Chapter#1 is just 40% of our research, lost of untold secrets will be shared in Chapter#2. NSA has acquired the capability to crack almost all the private communications encryption tools used by webmasters and cryptocurrency sites such as HTTPS, TLS/SSL, SSH, VPNs, VoIP or encrypted chat. New York Times mentioned N.S.A's capability to bypass private communications in following words:

According to an intelligence budget document leaked by Edward Snowden, N.S.A. spends more than $250 million a year to influence tech companies to insert back doors into encryption products.

New York Times discussed an encryption standard that was engineered by NSA with a fatal weakness and which was recommended as a secure protocol by both NIST and ISO in 2006, but the newspaper does not mention explicitly the name of that standard. Can you guess which encryption standard (which is very much related to Bitcoin) is NYT referring to?

The standard in question was the Dual Elliptic Curve Deterministic Random Bit Generator(Dual_EC_DRBG), standardized in NIST SP 800-90A. Experts and researchers had widely protested this algorithm, which according to experts included a potential back door that only NSA knows. Despite criticism, NSA succeeded in bribing RSA security with over $10 million to include the algorithm and surprisingly for seven years it was used as cryptographically secure algorithm in commercial products. Bitcoin software helps its users to create 256-bit long private keys using the Operating System's default pseudorandom number generator (PRNG) which works a lot similar to Dual_EC_DRBG to create a random number. Bitcoin community claims its the most secured PRNG and its impossible to guess a private key. They often give examples such that guessing a private key (2256 = 1.158 * 1077 ) is like picking an atom from universe. The probability of which is 1/1077 Such examples are fairly impressive practically but theoretically, the existence of a potential back door (master key to predict the stream of "random" bits) can never be ignored because N.S.A is far more unpredictable than one can imagine. NSA has hired the best mathematicians and programmers across the world. Free encryption algorithms they propose for commercial use are so smartly created that it is almost impossible for general public or independent cryptographers to find a vulnerability in it using a home PC or laptop or an ASIC. NSA's success is its custom-built super computers that are not accessible to general public. A collision attack to the hashing algorithm SHA-1 (created by NSA) was found 20 years later by Google, surprisingly bitcoin uses SHA-256 (also created by NSA) all over its infrastructure from creating bitcoin addresses to hashing blocks during mining. Can anyone guarantee there exists no back door to SHA256? It took a giant company like Google to find a vulnerability in SHA-1 after 20 years, how can any bitcoin user in his full senses make bold statements that there exists no backdoors to bitcoin protocol features which uses SHA256? What would you call it: Stupidity or Ignorance? I leave it to you. NSA Is Known For Bullying Tech CompaniesClassified documents provided by Edward Snowden made it quite clear how tech companies operating within United States or abroad are being bullied and forced by N.S.A for their voluntary collaboration, either through judicial court orders or by altering their software or hardware. Companies that don't surrender to NSA's non-stop bullying, have to shut down their services. One such example is an e-mail encryption company called Lavabit, that closed rather complying with the agency's illegal demands for access to customer information. Another example include the e-mail service company called Silent Circle which preferred closing its service than facing such demands by NSA.. According to New York Times:

NSA combined with IMF is far more unpredictable than one can imagine and no socio-political thing can happen on a large scale on this planet without taking them into confidence. It is nonsense to believe that the large scale media coverage worldwide given to Bitcoin and billion dollar investment being done to promote bitcoin network, is a result of voluntarily participation by some libertarians, internet activists or "freedom fighters". Isn't it weird that an agency that can crack through VPNs, TSL/SSL, HTTPS, SSH, Encrypted Chat and Encrypted VoIP, is so silent at disclosing the creator behind bitcoin who remains online 24/7, uses social media actively, posts on forums and emails colleagues on daily basis. Satoshi Nakamoto (Szabo Nick) uses the same tools (Google, Microsoft, Facebook, Twitter, Apple, Reddit, Github, Web hosting companies etc.) on daily basis that provides easy access/back door to NSA through Sigint Enabling Project and Bullrun Program, but the most advanced spying agency of the world acts as if it is completely ignorant of who created bitcoin. Interesting isn't it? In a nutshell it is impossible for crypto companies to operate with so much freedom online, in presence of the Five Eyes: N.S.A. and its counterparts in Britain, Canada, Australia and New Zealand. The speed and momentum at which crypto community is organizing seminars, workshops and running cryptocurrency promotional campaigns online and offline across the globe is impossible to occur without complying with this unforgiving spy agency i.e. National Security Agency. The utter silence of N.S.A towards the massive development going on around Bitcoin and Ethereum, is a clear indication of who controls the strings. Bitcoin is the Same Old Tea In a New CupCryptocurrency is indeed an extension of centuries' old financial practices. It is just an innovative representation of the entire world banking system, in which real assets are converted into bogus digital assets. Its the same old tea in new cups! The ruling elite mercilessly bombed two nations when they posed the slightest threat to their bogus monetary system, killing up to 600,000 people. i.e. Iraq for trading oil for Euros and Libya for trading oil for gold. How can anyone in his full senses believe, you could build an electronic monetary system under the nose of N.S.A without it being able to react? Anyone who believe in such fairy tales, surely lives in Disney World. Through bitcoin, the elites are studying human reaction. For the success of bitcoin it is important that the elites may condemn it softly on mainstream media to let people believe on this bogus currency even more and blindly trust it as act of opposition to the Elites. Once they have convinced at least 50% of the people, they can come out of the curtains to show their real faces through strict regulation policies and complete take over of exchanges. Bitcoin holders and the puppet bitcoin foundation will be able to do nothing but surrender to the new laws put forward by them. This is how they will unveil the second biggest monetary scam in the history of mankind. Forcing the entire world towards an electronically controlled monetary system. This new cryptocurrency by NSA will be the final version and it will completely wipe out Bitcoin and all other cryptocurrencies when it's launched. All it would take for the elite to have the masses begging for a solution is a global collapse (probably the dollar collapse) that may last a few months to a year. When people are in chaos and panic they'll beg for whatever solution the ruling elite are willing to offer. N.S.A and The Banking Elite Won't Impose Anything By ForceBe it a cashless monetary system via cryptocurrencies or Universal Digital Identification using blockchain technology and biometrics(Iris scanning and RFID), none of these goals will be implemented by force because the trick is to convince people that such technologies is in their own self-interest and may even deliver personal benefits. The people will be brainwashed enough to demand it themselves. The recent incident where the European Parliament approved the General Data Protection Regulation (GDPR) in April 2016, is the first move towards programming people to demand the right to be forgotten and full ownership of their user data. That is one practical feature of an editable blockchain technology only. GDPR is proudly mentioned by ID2020 on their website and they also mention that the demand for digital identity is naturally coming from the public side (thanks to their convergence tactic):

ConclusionThe greatest magic trick ever pulled on mankind was the theft of the world's money. 100 years ago everyone around the world had gold or silver in their wallets. Today, nobody does. It all disappeared and ended up but where and in whose wallet? Today we are just passing around worthless paper receipts from one hand to another(which we call currency) which used to represent the money that everybody no longer owns. The reason it is the greatest magic trick is that most people today don't even know that their true wealth was stolen right in front of their eyes. The magic trick used a simple tactic of deception which was: "Let me trade with you this awesome piece of paper for your crappy gold coin." With bitcoin, the trick has not changed the slightest but the toy did: "Let me trade with you this awesome digital gold coin for your crappy gold coin." --------***--------- Congratulations on completing Chapter#1! Your journey is 40% complete. Please proceed to read Chapter#2 where you will discover shocking secrets and technical reasons backed by logics and rationality to prove Bitcoin as the greatest scam and fraud in the history of mankind after paper currency. Chapter#2 is 60% of this comprehensive research and the soul of what we have discussed so far. Read it to believe it, as we continue unfolding the darkest secrets of mankind's lust for power. 45+ Reasons To Prove "Bitcoin is Scam and Fraud" Note: Productive discourse does only make sense, once full picture is shown. You can surely post your queries or feedback below but I encourage you to comment only after you have read Chapter#2. | ||||||||||||||||||||||||||||||||||||||||||||

| Bitcoin, RFID, Blockchain and the Cashless Society Agenda – CHAPTER[1.11] Posted: 12 Jun 2018 09:26 AM PDT If your were to ask: What can NSA and the banking Elite achieve with Bitcoin? Simple Answer → Global Control More than 2.5 billion adults do not have a bank account or use formal financial services. To bank the un-bank is one of the primary goals of cryptocurrencies. Electronic currency such as Bitcoin, will snatch away the right of even seeing or touching your true wealth. Thus moving the mankind towards a complete cashless society (They have already achieved it in Sweden) for global domination and far greater control through microchips embedded in your mobile phones followed by biocompatible microchip implants such as NFC RFID chip under your skin. The biggest constraint in the path of NSA to track human activity is wireless money or cash. With a cashless society run by cryptocurrencies, NSA will literally get the "eye of the god" that it has always sought to achieve. CASHLESS = NSA Can Trace Your Source CASH = NSA Can't Trace Your Source GOLD = FED Can't Corrupt It + NSA Can't Trace It (Any monetary system backed by Gold) Today all fiat currencies are in a race to zero – competing with one another on who can print more money faster. Since the elite and their think-tanks have already realized that they can no more fool the world with Quantitative easing, they have already laid down the framework for a new monetary system that is modern, electronic and based on cryptography. A System that will discredit the real money i.e. Gold with a bogus electronic imposter such as Bitcoin. By providing a 'modern' currency as a tool, NSA can collect sensitive information from around the globe and just like for Facebook/Google, users will voluntarily provide this information themselves. Thus helping spy agencies to bypass local government cyber laws without detection. It's the exact same strategy like putting the listening device in the electronic chips at the manufacturing level, thus saving NSA the trouble of wiretapping or electronic eavesdropping that can fail or be blocked. It's impossible to stop a smartphone from listening to you today, unless you physically rewire the device. Bitcoin is the same strategy on a financial level. By using Bitcoin you're giving up your private financial information voluntarily. All your bitcoin transactions are on the blockchain's public ledger that can easily be traced. Bitcoin exchanges & wallet services are already under the surveillance of this American intelligence agency. What? Aren't Bitcoin transactions anonymous and untraceable? Yes that's exactly true but solely for you not THEM, thanks to several backdoors that are always unknown to the end user. NSA's Dual_EC_DRBG and collision attacks in earlier SHA-1 algorithm are the biggest examples. Those people who don't get this point resembles a kid who hides his toys in the garage and assumes that his dad will never find them. The Biggest Problem With Blockchain TechnologyNote that Bitcoin is not a blockchain. Bitcoin is an electronic currency protocol (software) that uses blockchain technology to store all its transaction records in this distributed immutable ledger. Blockchain in layman terms is an electronic ledger or database that records every Bitcoin transaction. Blockchain is where your bitcoin balance is stored. There is no doubt that blockchain technology is a new innovation that has unimaginable use-cases in future. But the blockchain technology has one serious security problem caused due to limited memory power of humans to remember long random numbers. A human brain can hardly remember 10 characters long random password then how can it possibly remember 64 characters long random alpha-numeric number such as this SHA256 hash value for our hashtag: #BitcoinIsScam

Since a blockchain is secured by cryptographic algorithms, the passwords or private keys used to access Bitcoin balance stored in the blockchain are 256-bit in size or in other words 64 characters long hexadecimal passwords. Memorizing these random alpha-numeric strings is extremely difficult and that is why bitcoin users use wallets to store their private key and public key. Saving these lengthy passwords in a wallet is the biggest security problem faced by every blockchain user. The private key is the soul of any Bitcoin funds similar to your ATM pin code or card validation code (cvc). If you forget or loose the private key, all your bitcoin fortune is lost forever! Wallet is where Bitcoin private key (32 bytes) and public key (33-65 bytes) is stored. You use this ECDSA key pair to access your bitcoin balance on the public blockchain. The public key is used to receive bitcoin funds while the private key is used to sign (prove ownership) transactions in order to spend those bitcoin funds A wallet can be a software (e.g: Coinbase, Electrum, Bitpay), hardware (e.g: Trezor or Ledger Nano S) or even a paper (also called cold storage). For more technical details on this topic refer Chapter#2. Unfortunately none of these wallet options is secure. Software wallets are easily hacked, hardware wallets get crashed or misplaced and paper wallets can easily be lost, misplaced or even stolen via a mobile camera! To see how bitcoin users have lost as high as $1 Billion dollars due to exchange hacks, please see the full list of cryptocurrency hacks on Chapter#2. So What Is The Ultimate Solution To Safely Store Bitcoin Keys?This reminds me of the same tactic of deception used by the elites i.e: Problem (long strings) → Reaction (difficult to memorize or store) → Solution (RFID) We will come back to how Bitcoin key pair is stored inside a RFID chip and how Bitcoin influencers are encouraging users to implant RFID wallet under their skin but first lets discuss what exactly is RFID chip and why it is the biggest threat to an individual's most precious asset i.e: Privacy. What is RFID Tag and how many Private Keys can it store?RFID stands for Radio-frequency identification. This system uses electronic tags, or labels attached to the objects. These tags help to automatically identify and track objects using electromagnetic fields. In layman terms, RFID tags are the automatic version of manual barcodes that you see on food items. RFID tag is in short a small, programmable barcode historically used to track pets or products. Unlike a barcode, RFID tag does not need to be within the direct line of sight of the tag reader, so it is either embedded or implanted in the tracked object. A RFID chip aka NFC (near-field communication) chip can be re-written a 100,000 times and costs less than a dollar. These tags may either be read-only or read-write. They can be made as small as you want, make it ant-size or dust-size (0.05 mm × 0.05 mm). Passive RFID tags requires no battery, instead, it receives power and data from a nearby RFID reader's interrogating radio waves. Active RFID tags uses a battery and can operate at a distance of hundreds of meters from the reader. RFID tags contain three major parts:

RFID tags are used for tracking and identifying any imaginable thing, from clothes to medicine, electronics, food, supply-chain, motor vehicles, books, door locks, and airplanes, tracking humans, animals or goods.

Note that 1998 is the exact same year when Nick Szabo (Nakamoto Satoshi) had a P2P digital currency design ready for a cashless society under the name "Bitgold" (aka digital gold), that was later re-branded by Nick Szabo as "Bitcoin" in 2008 using the pseudonym "Satoshi Nakamoto". Surprisingly 1998 is also the same date when Wei Dai proposed his B-money concept which inspired Nick Szabo so much that he started working on Bitgold that later became Bitcoin. Wei Dai's b-money is mentioned in the Bitcoin whitepaper. Refer Chapter#1.7 for all details. It could be just a mere coincidence or synchronized efforts of one organized group working for the cashless agenda since the birth of internet and integrated circuits. RFID chips are implanted easily inside a human body using a surgical process. The chip is injected between the thumb and index finger of a human. The RFID tag is considered to be "safely" shielded inside a tiny glass capsule (2x12mm in size), slightly bigger than a grain of rice. RFID microchip implants in humans is advertised to be biocompatible without causing any harm to human health although there are several cases of microchip–induced tumors (cancer) in animals caused by RFID implants..... RFID chip compared to a grain of rice RFID chip implants by Bitcoin users is done frequently these days for two reasons:

Bitcoin RFID chip can store up to 888 bytes of data at present that equals 888 keyboard characters. Since a Bitcoin private key is 32 bytes in size, a Bitcoin RFID wallet can thus store up to 27 private keys in total. The chip can store data for a decade, thus a rewrite will be required every 10 years to avoid data loss. RFID Surgical Implants Increased Rapidly after BitcoinRFID human implants and Bitcoin development has a lot to share in common. The first RFID tag was implanted under a human skin in 1988 when bitcoin was under development and b-money concept was already public. Just one year before Nick Szabo's "Bitgold" announcement, the Food and Drug Administration in the United States approved the surgical implant of RFID chips in humans in 2004. Please note that the work on bitgold started in 1998, way before the announcement by Nick in 2005. The secret power (can name it in my book only for censorship reasons) behind promotion of RFID chips is so strong that they even advertise its use on main-stream media in front of kids, teenagers and the adults. Watch Dr Oz promoting RFID live on American Television by calling it: "Meet the RFID microchip – a new technological breakthrough that's changing the way information and identification is stored and shared." Click here to watch the video In 2009 when bitcoin software was released for the first time, the same year a British scientist called Mark Gasson surgically implanted a RFID glass capsule into his left hand. British scientist Dr. Mark Gasson getting a surgical implant in his left hand with an RFID microchip (March 16, 2009) He did this to demonstrate how an RFID tag can be infected using a computer virus. In other words it was a public awareness stunt to make RFID implants more secure to any hacking attempts. Any guesses for this man in long moustache standing next to Gavin Andresen in the photo below? Note that Gavin Andresen is the lead developer of Bitcoin software appointed by Satoshi Nakamoto (Nick Szabo) and also the founder of Bitcoin Foundation. Refer Chapter#1.9 to see all important members of the secret Bitcoin team. This guy in long brown moustache is a rich Dutch entrepreneur called Martijn Wismeijer, also known as 'Mr Bitcoin'. He hit news headlines in 2014 after he injected two RFID chips into the back of his hands during a biohacking event to store his bitcoin private keys. He used one hand as a cold storage for his bitcoin keys while the second hand as a hot wallet for purchases. The chip can store 888 bytes of data. This action by Martijn Wismeijer was promoted so much in crypto news sites (of course by the elites) as if it was the best thing every Bitcoin user must do in order to protect their bitcoin wealth and make bitcoin a part of their bodies. Following is an extract of his interview to press:

Wismeijer also confessed that he is not alone with such a weird implant but that there are around 3,000 people with a RFID implant in their hands and the number keeps growing. Upon diving deep into who is actually sponsoring or creating these NFC compliant RFID chips, I stumbled upon Dangerous Things which is a company located in Seattle USA and which sells a complete pre-loaded injection kit for DIY RFID implants called xNT NFC Tag for just $99. Dangerous Things is the same company that implanted RFID chips in many bitcoin users including Martijn Wismeijer. Following is the logo and slogan of the company which speaks for itself. Rockefeller's favorite symbols i.e. the circle and the triangle. I have also quoted Nicholas Rockefeller famous leaked secret to Aaron Russo when he told Aaron in 2000 on what have Rockefeller dynasty planned up for future: "All money will be in RFID Chips and there will be No Cash" Following are some more (mind programming) videos by bitcoin influencers with RFID chip implants. World first bio-payment with BTC (2015) Chip Implants - The New Credit Cards (2016) NFC Chip Implant Bitcoin Payments in Paralelni Polis [Again a triangle..] (2016) Convergence of all such technologies is surprising as you will discover ahead. Future Plans for RFID chips and Blockchain TechnologyThroughout my research on Bitcoin I saw astonishing number of synchronized events that can't happen naturally without the backup support of a global, extremely skilled and resourceful organization. The organization has immense influence over intelligence agencies, banking elites and all major world governments working under its umbrella. This secret organization looks so motivated and dedicated towards its ultimate goal, that it leaves no finger prints behind while achieving a goal just like they did during the great American depression of 1930s, during WW2, 2008 Arab spring, 9/11, war on Afghanistan and Iraq and the unrest in Middle east. This organization is extremely advanced when it comes to science and technology. The gadgets and tools they use today, the world sees it 20 years later. Note: You can request a copy of my book once I announce it for uncensored details. There is a limit to what I can share or express online. The two biggest victim cards that this organization often use to mind program masses are:

When they wish to bomb an entire nation, they will simply play the terrorism card and turn that nation to ashes. Global domination tactic. When they wish to infect an entire future generation with mind programming viruses (mankind has never heard or seen before), they will play the health card to vaccinate every child through force and power. Parents who oppose it, faces consequences at the hands of law enforcing agencies. Global enslavement tactic. Poor or developing countries where these vaccines are given, don't have a single laboratory, advanced enough to find the actual chemical composition for themselves. They just follow as guided. Human mind is an advanced version of a microcontroller. You can feed any information into it that you want. In computers its done through a code, in humans its done through food and media. Some people may strike me for sounding more like those conspiracy theorists but as a computer system engineer and as a father to a 2 years old baby girl, I was as astonished as you are when I saw government officials forcing me and my relatives on gun point to allow polio vaccination to our kids in Karachi, Pakistan. Our mistake was just one: As parents, we just inquired about the exact chemical composition of the vaccine but the armed officials had nothing to present expect force. When I was a teenager, I was so distracted by music, movies, fashion and celebrity lifestyle all around me that I never bothered investigating anything but as I grow mature and became a father, I started connecting the dots to see the full picture. Believe it or not, right now while I am writing this section of my research on BitcoinIsScam, I am sitting in general ward of Medicare Hospital Karachi, next to my mother's bed. My mother is a CLD and diabetic patient and she is suffering through a lot of mental and physical pain. To confirm my doubts and further bring proof to these observations, just 5 minutes ago, I asked a group of 5 doctors and nurses about the chemical composition of polio vaccine but I found them dumb found. When I asked if there exits any laboratory in the city or entire country that could figure out the chemical ingredients of this vaccine, the answer to this question was again in negative. Then I asked where exactly are these vaccines created, they all answered: United States of America. I leave the rest to you. How are these two Cards related to Blockchain and RFID?The elites want to identify and track every living human being via blockchain technology before 2020 and via RFID chips before 2030 respectively. ID2020 and the Editable Blockchain ID2020 was launched in 2014 as a so-called nonprofit organization that claims to improve lives by giving every individual a digital identity. As expected It is funded by the same elite dynasty of The Rockefeller Foundation (yes you heard it right), and technology provided by Accenture. On its website, ID2020 first offers its usual cheese cake by playing the health card and criminal card and the Rockefeller's favorite card i.e. Woman card. According to ID2020 a digital identity is important because:

I wish what they mentioned in their website was their actual goal and ambition behind digital IDs because this world is not as idealistic as it is shown. If ID2020 and other organizations talking about peace and human development such as UNO, World bank and IMF were so sincere than there would have been no wars where innocent women are raped, no 20 million refugees looking for shelter, no hunger in Africa and no fireworks in daylight in Syria. After giving the cheese-cake, ID2020 came straight to the point on how it will achieve its goal. I have bracketed and highlighted some details to give you an idea of what they actually mean:

Note that by biometrics, ID2020 refers to RFID chip implants only, not Iris scanning or fingerprints because they are too slow, expensive and offers no automatic tracking or identification. The blockchain technology used by Accenture for serving ID2020 agenda will be an editable one contrary to immutable blockchain where a record once uploaded can not be changed or deleted by anyone thus guaranteeing 100% transparency. Accenture has published its report too with title "Editing the Uneditable Blockchain". Editable blockchain in layman terms means, the control-switch of your digital identity will remain in Uncle Sam's hands with no transparency. You will act as he wants else you will be switched-off (pulled off the blockchain a.k.a off-chain) of the cashless system and socially boycotted from access to food, health or education. David Treat, who is Accenture's global head of blockchain says blockchain will be made editable using a "surgical fix", referring to Bitcoin creator Nick Szabo's smart contracts which can be used to program the blockchain features as you want. He says immutable blockchain is not practical because:

I hope you get the entire point of who offers a lollipop and who snatches it back. Decentralized cryptocurrencies and immutable blockchain was a cheese-cake while centralized (state controlled) cryptocurrencies and editable blockchain is the ultimate objective of these elites. It always comes down to the same tactic of deception: problem > reaction > solution. To give you an idea of how public is brainwashed by showing only the positive side of so-called trusted digital identity with blockchain and biometric, watch the video below by Accenture and observe something that only people reading this research will get it: Did you observe something weird in this video? There are two things worth mentioning:

At present the UN is experimenting with Iris scanning to gradually prepare refugees and society towards digital identity and cashless transactions but in future they will ultimately move towards RFID chip implants because people with no hands have no fingerprints and those with no eyes (the blind) can't get an identity with iris scanning. Watch the video below to see it for yourself how the World Food Program is using iris-scanning combined with blockchain technology to allow Syrian refugees in Jordan to purchase food without coupons, cards or cash. The biggest experiment of the cashless society agenda on over 100,000 Syrian refugees. No doubt helping humanity is a great thing but Imagine those Syrian refugees who fail to comply with UN policies, how easy would it be to identify them and get them off-chain? Chipping people is impossible unless the society is first gradually convinced to a cashless medium of exchange to pay for food, health and education as you have seen in the case of Syrian refugees. The execution of digital identities via Iris scanning and ultimately with RFID chips will come next as people will be ready to accept it by will. Bitcoin and its army of 1800 cryptocurrencies is doing their job quiet well in gradually motivating people to become habitual to cashless transactions using digital identification. What is Wrong About Digital Identity, Doesn't It Sound Cool?With digital identities on an editable blockchain and RFID chip implants (or even Iris scanning), you will literally be no different than a chained slave with a swinging sword on your head. You will either comply to the rules set by the cashless system or starve to death. With an RFID chip under your skin your privacy is over and you are no more a free human being. With further improvement in RFID system such as long-distance detection of the chips by tag readers, greater memory sizes and power source, you can easily be located physically by coordinates, speed, and direction of movement, just imagine the misuse of such power by a government to enslave its civilians or torture its opponents. In the book SpyChips: How Major Corporations and Government Plan to Track Your Every Move, the author emphasizes on the fact that how FRID tags embedded inside consumer products only can invade your privacy:

The convergence of cryptocurrencies, blockchain technology, and RFID chips will inexorably lead to the end of the cash and privacy. Massive unfair taxes, inflation, negative interest rates, unjust rules, immoral public freedom, anti-religion laws, different laws for poor & rich and fiat monetary system worse than paper currencies will be imposed by force, with an individual having no right to even object or participate in public protests. You will do as guided else you will be kicked out of the system (i.e. off-chained or socially boycotted). Assigning digital identity to humans is the complete transfer of an individual's God gifted freedom, liberty and privacy to the tyranny of the elite, the final suppression of all means of escape. | ||||||||||||||||||||||||||||||||||||||||||||

| Banks Don't Hate Bitcoin Because They Funded It – CHAPTER[1.10] Posted: 12 Jun 2018 09:25 AM PDT We all know that power in this world reside in the hands of the wealthiest of the society and by that I mean the banking elite who are the biggest tricksters on earth. Bitcoin is marketed using the deceptive tactic that bitcoin means death to centralized banking system or death to the Rothschild and Rockefeller family. Really? Imagine that you (Banks) know that your enemy (Bitcoin) is coming towards your home (FED) with a burning torch in his hand to set it on fire, yet you are welcoming (Silently marketing bitcoin) him with open arms. Either you are insane or you already know that, the one holding the torch is in fact on your payroll to just fool the world. When a monster is bitten on its legs and it does not even reacts, know that the monster was bitten as per its will. Imagine a currency which is a threat to Bankers is openly promoted on corporate TV channels like Bloomberg by the very same bankers who own it? Throughout history the banking elite succeeded because they changed the very definition of money and convinced the laymen in believing that economic activity depends "more on psychology than physical attributes". This bogus ideology is the biggest tool the elites have used to brainwash the society and have helped them to lay the foundation to a corrupt monetary system. The elites are using the exact same logic this time to legalize the use of fiat cryptocurrencies this time. Precious metals were replaced by fiat tangible paper currency and this time it will be replaced by fiat intangible electronic currency. Both of which have zero intrinsic value, are inflationary in nature and are easily corrupted because they are backed by nothing but lies. Want to know how they brainwash public to gradually shift the monetary system to a cashless society? Keep reading! Former director of the US Federal Deposit Insurance Corporation (FDIC) Sheila Bair who according to Forbes ranking is the world's second most powerful woman after German chancellor Angela Merkelhas, has now been given the task of mind programming the public towards cryptocurrencies. Sheila Bair is now a member of blockchain startup Paxos' board of directors. She openly supported Bitcoin and emphasized that it should not be banned and instead it should be legalized after regulating it. She used the same bogus logics of deception to declare bitcoin as a currency despite clearly knowing its fiat nature. In an interview with Barrons, Sheila Bair said:

Her last line should have been "That's true of any fiat [bogus] currency" but no she didn't because this is not what she is hired for. She just gave a green signal to yet another fiat currency and welcomed it to further poison the monetary system. You will be surprised that Bank of England is already working on a cryptocurrency called "RScoin". Bank of England is the second most oldest bank of the world established in 1694 and is the model on which most modern central banks have been based. Bank of England is largely responsible for reshaping financial policies globally. They are in short the founders of the corrupt fiat monetary system that we are living in. On 21st February, 2016, the Bank of England announced that it had partnered with researchers at University College London to create RSCoin, a cryptocurrency designed for central bankers. RScoin is coded and created by two students from University College London called George Danezis and Sarah Meiklejohn. The students have even released a whitepaper entitled as "Centrally Banked Cryptocurrencies" where they offered a protocol based on the same blockchain technology offered by Nick Szabo (Satoshi) but which is far superior to that of Bitcoin solving problems of scalability and computational cost. The abstracts reads like this:

Bitcoin users, Congratulations for acting as good test dummies! If it were not you guys, the elites (Bitcoin creators) would have never realized the flaws with Bitcoin and would not be able to fix it in coming optimized versions. Continue singing anthems of freedom while they continue studying your reactions. What does the letter "R" and "S" stands for in RScoin? No where in the whitepaper have the developers explained why did they gave this coin this name. Based on my wild guesses the letters "R" and "S" in RSCoin could stand for Royal Scots Coin or Royal Scottish Coin. According to wikipedia:

The legendary Unicorn of Scotland is often seen onto a range of collectable coins such as the Royal Mint. The mythical Unicorn of Scotland can be seen all round Britain in places from pub signs to passports and city badges to sport. I am sure the RSCoin stands for Royal Scots Coin or Royal Scottish Coin, a symbol of power, wealth and global control for the British ruling elite. The story does not end with RSCoin, the second biggest cryptocurrency which is under development and will soon be released is the U.S. Government's Fedcoin. Fedcoin is a cryptocurrency funded by the U.S. government and managed by the Federal Reserve Bank, where the complete history of all transactions will be visible only to the Fed authorities via the centralized blockchain. Its a centralized digital currency powered by a private blockchain, owned and controlled by the Federal Reserve. The Fedcoin idea was presented by David Andolfatto (yes on a Blogger blog!), Vice President, Federal Reserve Bank of St. Louis, at the International Workshop on P2P Financial Systems 2015. Andolfatto's blog post confirmed the agenda of a cashless society further when he mentioned that cash does not leave a paper trail but digital currency like Fedcoin and Bitcoin does leave a trail:

Former FDIC director Sheila Bair The banking elite are in full action now to gradually convince masses about accepting cryptocurrency. What shocked me the most and proves this research transparent is the recent blog article on Yahoo Finance by Sheila Bair (Former FDIC chair that we discussed earlier) in full support of FEDcoin. Sheila says the Fed needs to get serious about its own digital currency and she openly explained how it can be achieved: In start she acted like all banking elite as if she doesn't even know who Satoshi Nakamoto (Nick Szabo) is by saying:

Go back to chapter#1 and read when I predicted that bitcoin's current problems of scalibility, volatility and energy consumption are intentionally planted by banking elite so that when the final version of the centralized bank-issued cryptocurrency is introduced, all these current problems of bitcoin will be used as an excuse to mind program people to switch to a more secure cryptocurrency model. Read it yourself what Sheila wrote:

and then she came straight to her point:

And finally she uses the same emotional card of poor and rich to hypnotize people with her horrible solution to current fiat monetary system by providing the public with yet another bogus solution to keep them enslaved for yet another half century.

I leave the rest to you. In a world of thousand dotted lies and trickery, only knowledge helps one to connect the dots and make sense out of it. These are the same

You have seen the plans of the world's two biggest and most powerful banks for national cryptocurrencies and how they are using Bitcoin as a testing tool, and since both these banks come under the umbrella of the real banking gods (Rothschild and Rockefeller), I hope you might have a clear idea now about what to expect next. By the time I was writing this article, the bankers who were merely acting to hate bitcoin have actually started embracing it! According to the details provided, Rothschild Investment Corporation has acquired shares of Bitcoin Investment Trust (GBTC) for $210,000. Rothschild, the banking elite family has now become a bitcoin stakeholder - Reported by the Bitcoin official website itself. Funny isn't it? Furthermore the Rockefeller family's venture-capital arm Venrock ("Venture" plus "Rockefellers") has recently announced its partnership officially with the cryptocurrency investor group, CoinFund, to fund and sponsor blockchain based startups and cryptocurrency businesses. The Rockefeller dynasty is one of the richest families with an estimated net worth over $1 trillion USD. I hope its is now crystal clear who funded all this cryptocurrencies drama behind the curtains and now the same actors are coming in public after having successfully hypnotized the world once again. Bitcoin is just their test dummy to study human behavior to electronic currencies. Their biggest aim is to get people addicted to the use of cryptocurrencies as much as possible. Their ultimate goal is releasing central banks issued cryptocurrencies backed by nothing but the same lie that backed fiat paper currencies to this date. Want to see a real-life proof? Carefully read the press statements of MasterCard top officials from 2016 to 2018 in favor of digitization through private blockchain technology. In 2016, during an interview with Indian news publication the Business Standard, Rob Reeg, MasterCard president for operations and technology, said:

In 2017, MasterCard president and CEO Ajay Banga has broadly dismissed all non-regulated cryptocurrencies such as Bitcoin as 'junk'. In a media interview given to the Economic Times, Ajay said:

In 2018, in an interview with the Financial Times, MasterCard Asia-Pacific co-president Ari Sarker openly expressed their willingness to support national digital currencies that are issued and backed by central banks.

Did you get the idea now? This is how people are brainwashed gradually by the very same elite. Bitcoin is nothing but a well planned experiment to make people addicted to electronic currencies so that when the curtains are pulled, they may face no serious agitation. Rothschild and Rockefeller are the only two families that rule over 50% of banking industry. To prove they are not behind bitcoin, they often give rivalry statements just to increase the public faith more into their bitcoin paid puppets who talk ill of banks. This is a preplanned script played just before they could unveil their final plan.. CEO of JP Morgan, Jamie Dimon recently came forward and said:

He also said he would "fire in a second" any JP Morgan employee who is found trading Bitcoin for two basic reasons:

Ironically in media they do give such statements but in reality they are more hypocrites than you can think. The same JP Morgan Chase is a public member of Enterprise Ethereum Alliance. Ethereum is the second most popular cryptocurrency after Bitcoin and it also provides the technology to create new cryptocurrencies and blockchain applications. If JP Morgan thinks bitcoin is fraud so its CEO must also confess that Ethereum is fraud too because the founder of Ethereum, Vitalik Buterin was a programmer involved with Bitcoin and is the co-founder of Bitcoin Magazine. Vitalik was so impressed with Bitcoin, that he went on to create his own OS for cryptocurrencies called 'Ethereum' (though he was backed by Nick Szabo) which was initially crowd funded using Bitcoin. Funny isn't it? UPDATE: As expected these bankers only act according to a script. The hypocrite banker of JP Morgan now actually supports bitcoin and even his daughter has bought two bitcoins recently. His initial drama was only to let people believe that Bitcoin is actually a threat to banks so that more and more people could buy bitcoins. This is how banks play with people's minds. They have always fooled humanity through the art of hypocrisy. In other words Bitcoin and Ethereum work similar to how Rothschild and Rockefeller banks have been working to fool general public till this time. Despite knowing how bitcoin has made criminal activities such as child abuse imagery, terrorism, money laundering, tax evasion and drug sale extremely easy on Darknet marketplaces, the intelligence agencies are refrained from talking ill of bitcoin. In October 2013, the Silk Road marketplace, which used to sell illegal drugs online, was shut down by U.S. law enforcement. Instead of requesting the Govt to start a campaign to ban bitcoin trading worldwide with the help of its allies, the FBI indirectly supported bitcoin with its statements of love for it. Astonishingly FBI will keep all the seized bitcoins with them but will never give it back to the rightful owners. This is enough an evidence, how NSA and its sponsors (the Rothschild) are experimenting with Bitcoins to study human reaction.

To prove our point more with a solid proof, check out the love message of IMF Chief Christine Lagarde, given in favor of cryptocurrencies to central bankers. She told bankers to start giving importance to the rising popularity of digital currencies instead of being Luddites. She said that this new digital currencies which are created and exchanged without involving banks or governments could in time be embraced by countries with unstable currencies.

In order to let people believe that bitcoin is not a product of these banking elites, they are playing the propaganda on both sides: On Crypto-Community Side: "Abuse banks and talk bad about fiat currencies and governments. Convince people to start treating bitcoin as a digital asset created by a Jesus like Messiah called Satoshi. Convince people that all this billion dollar investment in digital currencies and the ICOs, is being done by internet keyboard warriors with no support of Rothschild/NSA at all". On NSA and Banking side: "Let them keep on issuing negative statements against central banks and national financial authorities. Let people believe cryptocurrencies can save them from this cruel financial system. Once more and more people have adopted it, we will unveil our true cashless-agenda through power, influence and crypto-gods that we have been breeding". Anyone who thinks all this cryptocurrency trade is powered by individuals like you and me with no hidden power, is too fond of watching Marvel Studios movies! These banking elites have been ruling us for over a century because we are easily fooled emotionally and psychologically. Anyone who comes to us with a solution to our financial problems, we blindly trust them in hope of a better future. History repeats itself. Its just the same corporate scam of PROBLEM - REACTION - SOLUTION. Thus, one can surely conclude: BITCOIN = ( Created by NSA's Nick Szabo ) + ( Funded by Banking Elite ) | ||||||||||||||||||||||||||||||||||||||||||||

| Unveiling The Bitcoin Team Led By Nick Szabo – CHAPTER[1.9] Posted: 12 Jun 2018 09:24 AM PDT Now that when we know "Satoshi Nakamoto" is the Pen Name of the polymath "Nick Szabo" and that Bitcoin is a test dummy of NSA which is surely not coded by Nick Szabo alone. Let us see a partial (roughly just 20%) list of Nick Szabo's core team of developers and government agents that made practical implementation of Bitgold a reality by coding the Bitcoin client software. The picture below was leaked by a reddit user. This meeting of 20 core bitcoin developers was privately and secretly held at Princeton University in March 2014. Princeton university surprisingly did not publically share any details of this supper on there official website where they only mentioned about a public workshop on Bitcoin awareness and blockchain technology. The public conference was organized after that secret meeting. I present to you the real Satoshi Nakamoto (Nick Szabo) and his secret team of core bitcoin developers all sitting on a single supper table. [Click here to see enlarged view] Following is the complete list of people in the picture above along with there twitter handles.

Almost most of these attendees participated in the public workshop but guess who didn't participate? Yes you are right: Nick Szabo! The meeting at Princeton University Prospect House was kept secret for one single reason: Nick Szabo, the creator of Bitcoin was present there along with Gavin Andresen (the lead developer of Bitcoin appointed by Satoshi Nakamoto (Nick Szabo) and also the founder of Bitcoin Foundation) thus to avoid public exposure, it was made sure the two are never seen together but sometimes nature has other plans.... Did you recognize Dr. Edward Felten among this group? He was Deputy U.S Chief Technology Officer during Obama administration appointed in May 2015. He was responsible for making technology and science policies. A future government officer, Bitcoin creator and 20 core developers all on the same table and meeting secretly... Interesting isn't it? All public videos were uploaded to Youtube and also to Princeton webpage but as expected none of these videos included Nick Szabo. I am sharing one such video from that Bitcoin workshop and conference held at Princeton University, which includes Edward Felten amongst the panelists. Watch with your own eyes the gradual mind programming of academia in United States towards a bogus currency that is banned in many countries, marked as an illegal tender and which acts as the perfect tool for tax evasion, money laundering and darknet million dollar daily drug sale(all figures will be shared in Chapter#2). Building collaborations between developers and researchers

Edward Felten, Department of Computer Science, Woodrow Wilson School, and CITP, Princeton University Greg Maxwell, Core developer, Bitcoin Project Andrew Miller, Department of Computer Science, University of Maryland Alan Reiner, Core developer, Armory Bitcoin Client Once this picture was leaked a staff member at Princeton University had no choice but to confess that such meeting actually took place. Although he tried acting like if it was nothing too big to be discussed and that Nick Szabo's attendance was nothing exceptional. Read his excuses here. | ||||||||||||||||||||||||||||||||||||||||||||

| Where Did ‘Nick Szabo’ Code Bitcoin Software? – CHAPTER[1.8] Posted: 12 Jun 2018 09:24 AM PDT The email letters that Hal Finney (First person to receive bitcoin transaction from Satoshi. He died in the same year, 2014. Surprisingly Finney is Nick Szabo's closest friend since 1993..) supplied to The Wall Street Journal in the spring of 2014 and which were written in Jan 2009, has a bitcoin address that Satoshi shared with Finney which has initials matching Nick Szabo's name.

This bitcoin address starts with 1NS as the first two Base-58 capital letters where "1" is the default prefix for Bitcoin pubkey hash while the string that follows after "1" is generated upon desire (Vanity address). In this case the custom address starts with "NS" and not "ns" or "Ns" but both Capital alphabets which looks like a desired abbreviation to: NS → Nick Szabo Instead of writing it as SN to match Satoshi Nakamoto, Nick mistakenly chose NS because the original name is always strongly fed at the back of one's mind and during instant emailing, keeping your self focused on both the algorithm and secrecy at the same time is quite difficult sometimes. This is where Nick made another big mistake. Some critics may argue that I am intentionally making a story out of it and the above address could be just an arbitrary address generated by chance? Or that if Satoshi Nakamoto really wished to use his name then he could have simply created a vanity address with his complete surname i.e. 1Satoshi Let's use some old school mathematics to prove my stand: What is a Vanity Address? Vanity address is valid bitcoin address that contain a custom message in human-readable format. Such as this address: 1MBTki12847iopshWBop2189HJyusqi248 , where MBT is the message encoded inside this public address. To create a Vanity address you will need to generate and test billions or trillions of candidate private keys, until you get the desired pattern for your bitcoin address. A base58 encoded bitcoin address is 34 characters long and it consists of numbers between 1-9, uppercase alphabets A-Z (excluding O) and lower case alphabets a-z. The characters excluded are: 0, O, I, and l. Now lets analyze how many bitcoin addresses can be created with prefix 1Satoshi and how much time is required to create such vanity address using a general purpose desktop computer PC. We know that an average PC not attached to any specialized hardware such as GPU or ASIC can search approximately 100,000 keys per second. The search for a pattern like "1Satoshi" (i.e. 8 characters) means searching for an address in the range from "1Satoshi11111111111111111111111111111" to "1Satoshizzzzzzzzzzzzzzzzzzzzzzzzzzzzz". So total possible combinations of bitcoin address that can be formed starting with 1Satoshi are: 58(34-8) = 5826 addresses (~ 7.0652549e+45) Quite a large set of addresses isn't it? Then why didn't Satoshi used it then? Because if he had chosen this vanity address then it would have taken his computer up to 8 months {(587/100000)/60*60*24*30} to find this perfect match out of (587) 2.2 trillion possible addresses! The table below shows the frequency of a vanity address pattern and search time required to find it on a desktop PC. Note: I used my mobile phone's calculator, frequency and time values are estimates, rounded off to the nearest integer.

I am sure Hal Finney could not have waited for that long to receive Nick Szabo's email response! Thus Nick Szabo chose to create a vanity address using just two characters "1NS" which might have taken his PC less than 50 milliseconds to search the desired public key. Simple math! If you notice Satoshi Nakamoto's (Nick Szabo's) email to Finney in 2009, Satoshi said: How can basic computer network connections turn to be a headache for a genius programmer like Satoshi (Nick)? Why couldn't he troubleshoot the network connection issue to allow incoming connections? Or is it that, he was in a highly secured building where computers require special administrative privileges that Nick Szabo didn't had or could not access? Which secured or secret building could it be, where Satoshi was coding the Bitcoin software? This takes us to our second most interesting part of the story. Is Bitcoin The Work Of A Single Man?Nick Szabo's 575 forum posts published at bitcointalk.org on a small interval of time from Nov 2009 to Dec 2010, suggests that, Bitcoin is not the work of Nick Szabo alone or a group of independent cypherpunks but an organized secret project backed by the world's best mathematicians, programmers, investors and cryptographers. The most likely suspect, capable, willing, and motivated to embark on such a massive monetary project could be none but NSA (National Security Agency).  Not everyone around the world knows that NSA is America's cryptologic organization, tasked with making (encrypting) and breaking (decrypting) codes and ciphers. No one can even reach the level of expertise NSA has in cryptology thanks to its 40,000 employees compromising of the world's best engineers, physicists, mathematicians, linguists, computer scientists and every other polymath around the world. Yes you heard it right, "cryptology", the basic science behind cryptocurrencies. NSA is a high-technology organization with the world's most powerful super computers that helps it to intercept any communication taking place around the world. It is responsible for global monitoring, collection, and processing of information and data for foreign intelligence and counterintelligence purposes, i.e. Signals Intelligence (SIGINT) The history of the National Security Agency dates back to 1917, when U.S declared war on Germany in World War I. During that time U.S military intelligence established a code and cipher decryption unit known as the Cipher Bureau. Communication Intelligence (COMINT) helped the United States and Britain to achieve significant successes against Japanese and Hitler's Nazi Germany diplomatic communications. it was officially formed as the NSA by President Harry S. Truman in 1952 Since then NSA has grown into a massive intelligence organization and is often engaged with global controversies. Every email that you send online via gmail, hotmail or yahoo can easily be read by an NSA employee thanks to the database access. Secret programs gives NSA backdoor access to Apple, Google, Facebook, Microsoft data. This is one reason why Google and Facebook is banned in China. Every social media mobile app or web app, can't do business in Silicon Valley unless NSA is given secret access to the user database. The recent controversy of Mark Zuckerberg selling user data to Cambridge Analytica is just tip of the Ice berg. Things only seem impossible untill the secrets get leaked out. NSA also has offensive cyber-warfare capabilities, like injecting malware into remote computers. I will explain in Chapter#2 how they helped in launching Ransomeware Attack worldwide using the EternalBlue exploit created by NSA. Ransomeware attack was a bitcoin publicity stunt made by NSA for Bitcoin promotion to increase its public adoption rate. NSA's spying, both foreign and domestic, was revealed for the first time to the world by former NSA contractor, Edward Snowden, in a series of disclosures beginning in June 2013. Today NSA's headquarter is located in Fort Meade, Maryland, U.S. with over 30,000-40,000 employees and with an annual budget of $10.8 Billion. All these heads are busy 24/7 to spy upon every targeted individual living on the face of the earth. Indeed they invent the toys that we play with and Bitcoin is just one of them. NSA was already working on cryptocurrencies, publishing its first white paper in 1996, twelve years before Satoshi's white paper was made public in 2008. Even the hashing algorithm ( SHA-256 hash function ) used by Satoshi, to secure bitcoin is surprisingly designed by NSA back in 2001! No one in the entire bitcoin community can claim, SHA256 is not vulnerable to collision attacks or it has no backdoors setup by NSA. NSA can afford to hire the best mathematicians and programmers. When any one of them proposes something, only a few people are able to understand the mathematical proof it's based on. A flaw could exist for decades before someone else find it by accident. As it happened with SHA-1 (created by NSA) when Google found flaws in it by performing a successful collision attack in 2017. Google and CWI was able to publish two dissimilar PDF files which produced the same SHA-1 hash. A collision attack in cryptography means you can achieve a single hash value using two different inputs or in other words, same output for two different inputs. In layman terms, two different keys for one single lock.. Any guesses when was SHA-1 released?

A silent message for Bitcoin worshippers whose foundation is based on SHA-256, an upgraded algorithm designed and crafted by the same spy agency in 2001. Only the original programmer of the script knows all backdoors/keys to the encrypted code. NSA is known to bribe institutes like NIST and RSA to include algorithms of its choice. The most popular incident of which is Dual_EC_DRBG. Dual Elliptic Curve Deterministic Random Bit Generator is an algorithm that was presented as a cryptographically secure pseudorandom number generator (CSPRNG) using methods in elliptic curve cryptography (used in Bitcoin to create private and public key). Experts and researchers had widely protested this proposed algorithm by NSA, which according to experts included a potential backdoor that only NSA knows. Despite criticism, NSA succeeded in bribing RSA security with over $10 million to include the algorithm and surprisingly for seven years it was one of the four CSPRNGs standardized in NIST SP 800-90A. According to wikipedia:

According to Zero Hedge Team:

Even if we ignore this huge amount of circumstantial evidence, still the most surprising evidence is the 1996 paper published by NSA itself, almost twelve years before the introduction of Bitcoin! "How to Make a Mint: the Cryptography of Anonymous Electronic Cash" You will be surprised to figure out, how smartly did NSA launch Bitcoin as a test experiment using the Pseudonym of "Satoshi Nakamoto" and by employing Nick Szabo and his entire team. According to "Crypto Coins News" Website:

Milton Friedman, one of the most successful economists, predicted crypto currency in 1999 and NSA had a design built already in 1996. NSA started working on crypto currency ever since Internet was born. According to Silicon Angle:

According to the CIA Project, Satoshi Nakamoto means "Central Intelligence" in Japanese. A Russian lawmaker also claims that Bitcoin is a CIA conspiracy:

Want to know how secure Bitcoins hashing algorithm is? Read this:

Cryptography researcher Matthew D. Green of Johns Hopkins University also said:

SHA-256 is used in two major parts of the Bitcoin network:

And finally here is the statement of former CIA employee and NSA contractor Edward Snowden. In an interview at 'The Internet Engineering Task Force 93', he talked on Bitcoin and its flaws and weaknesses.

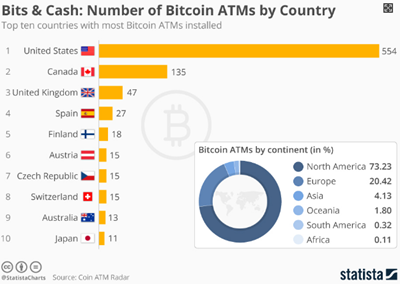

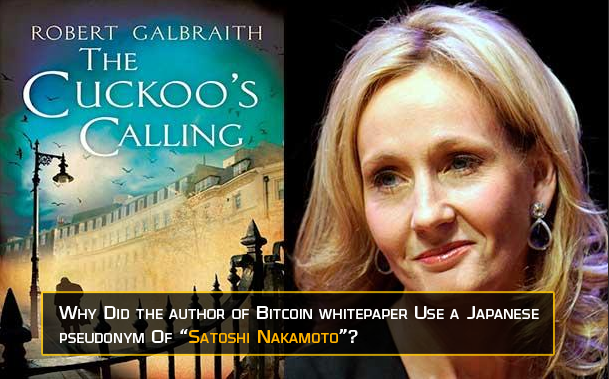

Why Is Nick Szabo Given a Japanese Pen Name?The first reason I shared was that since Dorian Prentice Satoshi Nakamoto lived just two blocks away from Hal Finney's home, this name might have looked interesting to Nick Szabo as it sounded like a good pen name which matched Nick Szabo's starting letters of his name. (i.e. N & S). So Satoshi Nakamoto translated just perfectly to Szabo Nick. The first reason is based totally on facts but my second reason could be my mere speculation or imagination that could be completely wrong but this is my best wild guess so far. My Wild Guess: Geographical background plays a vital role in diverting people's attention. Especially when it is Japan which in other words is a military base of USA and a strong political threat to China's growing economic influence in Asia. Japan and U.S are military allies and both are free open Markets and strong foes of China and Russia. Japan is located in Asia and Asia is world's largest and most populous continent. About 60% of all human beings living on earth reside in Asia. Using an Asian pseudonym for Bitcoin creator means attracting a large audience of 4.436 billion as test objects. Japan, South Korea, Taiwan and China are nations with average IQs over 104. Having them as test dummies and the lower belt of South Asia (i.e. India) to understand human behavior to this new electronic currency is of immense importance before a One-World Centralized Cryptocurrency is introduced by the banking elite. Using a Japanese name will also divert the attention of U.S citizens and Europeans away from the Rothschild and Rockefeller families. This is one reason why 73% Bitcoin ATMs are in North America (USA & Canada) and 20% Bitcoin ATMs are in Europe while only 4% are in Asia. Bitcoin users are more in USA, Canada and UK because they are being brainwashed to believe that Bitcoin is created by an unknown libertarian by the name Satoshi Nakamoto, who hates the fiat based monetary system and who created Bitcoin to free everyone from debts, taxes and inflation. Surprisingly this tactic is working as people always act like a sheep, believing in any fairy tale that may give them a hope of freedom from financial slavery. Because they always forget, that Devil is the master of all trickery.

The elites diverted all attention towards Asia because this is the region that has always showed extreme resistance to their bigger plans and agendas. They could have only used Asia's 4.436 Billion population as test dummies through a decentralized monetary system that could support cross-border transactions without any control of the local government to stop such financial activity. Thus Bitcoin with a public blockchain is the best suited system, the banking elite could use to achieve their experimental goals. Indeed, Bitcoin is just a test case! A complete cashless society is all that they are aiming for, to keep all masses under strict financial scrutiny for ultimate global domination through the power of a centralized cryptocurrency. | ||||||||||||||||||||||||||||||||||||||||||||

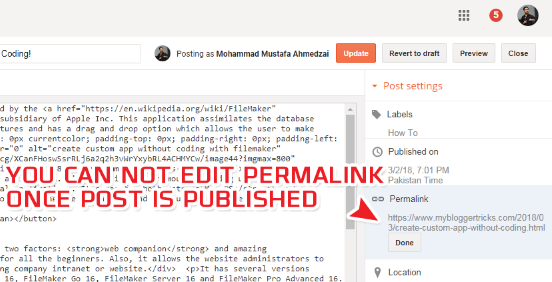

| How Did We Hunt Down ‘Nick Szabo’ To Be ‘Nakamoto Satoshi’? – CHAPTER[1.7] Posted: 12 Jun 2018 09:24 AM PDT I would have not been able to hunt down the real Satoshi Nakamoto if he had not tried to alter the timestamps on his blogger blog. After having thoroughly examined Nick Szabo's blog activity which is hosted on Google Blogger (same as ours), I have gathered enough evidence to prove that Satoshi is none other but Szabo. Just like how every bitcoin transaction is timestamped and recorded in the distributed ledger, Google blogger records it inside JSON Feeds. The JSON feeds data can be easily viewed publically just like Blockchain! That was a nice comparison btw! A timestamp is a sequence of characters that provides information when a certain event occurs, usually giving date and time of day. Every article, comment or video that you publish online, has its unique timestamp. In Blogger CMS platform, all data of the blog (users data, category list, authors names, profile links, post title, post URL, article content, thumbnails, published timestamp, updated timestamp etc.) is stored inside human-readable files called XML. Accessing data through XML is slow because it requires a XML parser to parse data. Therefore Blogger Data API provides JSON support which is a smart alternative to XML files. Using JSON Feeds, a developer can easily fetch information about blog posts or comments. You can read more about it by reading our comprehensive guide: Blogger platform records data by assigning two different timestamp objects.

In blogger blogs an administrator can easily change Post timestamps but he can not change comment timestamps and neither the URL structure called permalink. Even if the administrator tries to hide date inside blog comments (as Nick did by only showing time not date), we can easily get the exact date and time through Blogger JSON Feeds. Bitcoin's original name was Bitgold and it took Nick Szabo about a decade from 1998 to 2005 to convert his Bit Gold idea into Bit Coin reality. He shared his idea of a decentralized cryptocurrency entitled "Bit gold" for the first time publicly in 2005 on his blog. Those who have read the contents of this blog post, are shocked to find over 99% resemblance between Bitgold and Bitcoin key features or in other words the same concept but with slight difference of terminologies used for. Read the major points of his blog post below to get an idea of how he came up with the idea of bit gold to replicate gold in digital form and then match it with the Bitcoin whitepaper, everything will become crystal clear of how Nick Szabo made Bitcoin a reality:

Carefully read the red highlighted text where I have pin-pointed how through this bitgold protocol that he published in 2005, he led the foundation for bitcoin. Almost everything that is the building block of bitcoin is mentioned in this extract from blockchain, proof of work (PoW), mining, difficulty, computational cost, to the coins supply. But there is something more interesting with the timestamps of this article which confirmed my doubts on Nick even more as being the sole mastermind behind bitcoin. The following is a internet archives screenshot of bitgold article that Nick originally published on 29th Dec, 2005. Almost three years before Bitcoin white paper was released in Oct 31, 2008.

Note that Nick published this response just few hours later after an author by the name gwern published an article on 28th May, 2011, on Bitcoin weekly entitled "Bitcoin Is Worse Is Better". This article has been deleted by Bitcoin weekly (this is how agency react) because it raised some serious questions. You can read the article by checking this archive. Gwern argued why Bitcoin protocol was introduced so late when almost everything was ready almost 8 years before Satoshi's whitepaper i.e 2000?

Carefully read the points raised by gwern and you can easily connect the dots to draw the picture of the actual bitcoin creator. This is one strong reason why his post was probably deleted, although an edited version still exits on Gwern's blog. Nick was very quick in defending his position and promptly replied to this critic within hours but he had no time to answer Gwern emails nor his counter questions. Gwern even provided counter-evidence when Nick Szabo tried to divert the attention of his audience by calling Finney or Dai as possible Bitcoin creators in his post:

But as soon as Bitcoin whitepaper got published, in order to give an impression that Bitgold idea was actually inspired from bitcoin or that it came after bitcoin, Nick Szabo changed the timestamp (published date) of the blog post to a later date i.e. Dec 27, 2008. When he tried to change the permalink (date in URL), he could not edit it nor could he edit the comment timestamps because Blogger editor does not provide any such option. I will prove that through JSON feeds. Notice the first comment posted on that "Bitgold" post is by "Kay Bell" at 2:16 PM. Choosing a timestamp for comments with no date mentioned but mentioning only time [ 2:16 PM ] makes no sense, although Google blogger offers several useful ISO 8601 date and time formats as shown below: May be Nick enjoys keeping suspense in everything. :) To prove that the first comment posted on Nick's bitgold blog post is from 2005, I will use the following URL containing special parameters to extract the comment feed in JSON format:

Open the above URL inside a browser and search for "Kay Bell", you can then clearly see the published and updated timestamps for this comment as shown below: You can clearly observe the published and updated times in ISO format to be: 2005-12-29T14:16:00.000-08:00 The Date is 29th Dec, 2005 and Time is 14:16:00 or 2:16 PM This clearly proves the article was published in 2005 and not in 2008. The Published and Updated (Edited) times are same because Blogger does not allow editing of comments just like Twitter statuses. But surprisingly the Published time and Updated(edited) time of the Blog post timestamp in JSON Feeds has a one minute difference. To browse the Post Json feed, type this in your address bar and then search "A long time ago":

Note: The timestamp in Blogger Post JSON feeds can be easily changed to reflect the new timestamp unlike the comment timestamps which can't be changed. So the post feed will show date as 2008 and not as 2005. Now locate the bitgold text by typing "a long time ago" You can then clearly locate the published time as: 2008-12-27T16:16:00.000-08:00 and updated time as: 2008-12-27T16:17:00.164-08:00 You can see that the dates are same as 27th Dec, 2008 but the times (GMT pacific time) have a one minute difference. The post was published on 4:16 PM but was updated on 4:17 PM. I checked full content of the bitgold post in 2005 and 2008 and found not even a comma difference then what did Nick edit during that one minute? My wild guess is that after publishing the post, Nick might have observed the "2005" string in the URL and then went back to blogger editor to try editing the permalink from 2005 to 2008 but since Blogger does not allow that (unless you delete the post/comments and republish a new post loosing all old comments), he had no choice but to publish the post without any edits. Hence it is proved that Nick Szabo tried to deceive the non-techy internet community by tampering/altering his blog post timestamp to narrow down his connection with Bitcoin. What Kept Nick Szabo Busy after 2009?What is even more striking is that if you carefully monitor Nick's blog activity through the blog archives, you will notice that his post frequency decreased significantly from 2009 on wards when Bitcoin software was first released in Jan 2009.

He was posting over 40 posts per month from 2005 to 2008, but his activity decreased immensely from 2009 on wards when he posted just 29 posts. From 2010 to 2018, you can see he hardly managed time to write over 3 posts per month. The big question is: "What kept Nick Szabo so busy after 2009 that he could not manage time to blog?" Only one thing might have kept him busy: Transforming bitcoin dream to a billion dollar crypto-industry could have been the only activity that kept Bitcoin's original writer busy from 2009 onwards to this date i.e. 2018. Similarities Between Nick Szabo Whitepaper Vs. Bitcoin WhitepaperI compared Nick Szabo's Secure Property Titles whitepaper with Bitcoin whitepaper and this is what I found out:

Now lets analyze the headlines and reference section.

Throughout my life I have read different whitepapers released by Google, Facebook, Data scientists, Computer scientists but almost none has any resemblance to Bitcoin whitepaper or Nick Szabo's whitepaper which are both written in the same classical style and with almost same formatting. Stylometric Analysis Proves Nick Szabo is Satoshi NakamotoIn Dec 2013, an unknown blogger, who created a wordpress blog entitled "Like In a Mirror" analyzed the vocabulary patterns and speech patterns used in Bitcoin Whitepaper to compare them with writing materials of various cryptographers especially Nick Szabo, by running textual similarity metrics on several pages of their writing. His analysis of the stylometric characteristics of the Satoshi whitepaper indicated a much stronger match for Nick Szabo compared to other cypherpunks, such as Wei Dai, Hal Finney, David Chaum or Adam Back. He also emphasized that Bitcoin whitepaper indicates a match with Nick Szabo's writing tics, at a level that only has a one in a thousand chance to be a coincidence. According to him:

Some of the major similarities he found are:

He also took writing samples of other researchers involved with cryptocurrencies, such as Wei Dai, Hal Finney, David Chaum and Adam Back and ran several speech pattern recognition tests. The writing samples were from 5k to 40k word long. He then computed histograms of word length frequency and character frequency, and compared them with that of the original Satoshi whitepaper. His results were shocking as they showed a much stronger match between Bitcoin whitepaper and Nick Szabo's text patterns. Please note that units are arbitrary (smaller scores mean closer histograms).

He thus proved that Nick Szabo's writing matches the Bitcoin whitepaper, not only in the vocabulary pattern, writing style, but also on hard-to-fabricate style metrics. Another stylometric analysis was carried out by a Data scientist by the name "Michael Chon", who ran tests in two parts to find out which author(s) in the tests are linguistically and semantically similar to Satoshi Nakamoto. Even according to Michael Chon, Nick Szabo is the best candidate who is linguistically similar to Satoshi's Bitcoin paper and email texts. In 2014, a study, entitled 'Project Bitcoin', was undertaken in England by a team of 40 final-year forensic linguistics students led by Lecturer Dr Jack Grieve at Aston University. It compared the linguistic similarities of Bitcoin whitepaper with writing texts of eleven candidates who are often suspected to be writers of the Bitcoin whitepaper: Dorian S. Nakamoto, Vili Lehdonvirta, Michael Clear, Shinichi Mochizuki, Gavin Andresen, Nick Szabo, Jed McCaleb, Dustin D. Trammel, Hal Finney, Wei Dai, and Neal King, Vladimir Oksman & Charles Bry. According to Dr Jack Grieve: Notice just like many web pages which are deleted, the following Aston university page also no more exists but fortunately I could extract the contents of the page using Internet archives here.